smiltena/iStock via Getty Images

Investment Thesis

Vista Outdoor Inc. (NYSE:VSTO) mainly designs and manufactures outdoor recreation and shooting sports products. The company has recently acquired Simms Fishing Products, which produces and deals in fishing equipment and fishing apparel. I believe this acquisition can accelerate Vista Outdoor’s growth by introducing it to the rapidly growing market.

About VSTO

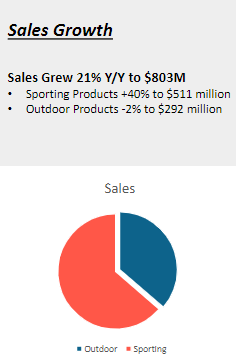

VSTO deals with designing, manufacturing & distributing outdoor recreation and shooting sports products. The company operates its business in two reportable segments: Sporting Products and Outdoor Products. The production and distribution of components, ammunition, and other related equipment and accessories are part of the Sporting Products segment. The Sporting Product segment generates approximately 57% of the company’s total sales. The Sporting Products segment mainly serves the military, recreational shooters, hunters, and law enforcement agencies and produces ammunition products such as rimfire, pistol, rifle, and shotshell ammunition. This segment further consists of the Ammunition operating segment, which operates the ammunition business, including Speer, CCI, Federal, and HEVI-Shot.

The Outdoor Products reportable segment focuses on designing, distributing, and manufacturing gear and equipment, which helps enhance end-users outdoor experiences. These end-users include hikers, campers, skiers, snowboarders, hunters, cyclists, and golfers. This segment produces unique hydration solutions, hunting and shooting accessories, outdoor cooking solutions, cycling accessories, action sports helmets, goggles and footwear, golf GPS devices, audio speakers used in outdoor sports, laser rangefinders, and golf launch monitors & simulators. This reportable segment consists of the Accessories operating segment, Sports Protection operating segment, Cycling operating segment, Outdoor Cooking operating segment, Hydration operating segment, and Golf operating segment. The Outdoor Products segment contributed approximately 43% of the company’s total sales.

The company has 26 manufacturing and distribution facilities in the US, Canada, Puerto Rico, and Mexico. The company sells its products through independent retailers and distributors such as Dick’s Sporting Goods, Kiesler Police Supply, Amazon, Academy, Sports South, Sportsman’s Warehouse, Nations Best Sports, and Walmart.

Sales Growth (Investor presentation: Slide no: 8)

Acquisition of Simms Fishing Products

During the Global Covid-19 Pandemic, the fishing product industry experienced a downturn in demand due to physical distancing restrictions. After easing these restrictions, the industry has seen a significant demand rebound, which is further expected to grow, considering consumers’ increasing interest in fishing activities. To address this rapidly growing demand, the company has recently acquired Simms Fishing Products for a purchase price of $192.5 million.

Simms deals in fishing apparel and equipment in Bozeman, which is well-known for fly fishing activities. It produces waders, bags, outerwear, footwear, clothing, and other tools and accessories. This acquisition has significantly strengthened Vista Outdoor financially by adding approximately $110 million in net sales. As per the deal, Simms will be anchoring a new platform for the fishing category products within the Outdoor Product segment of Vista Outdoor.

The company operates in a highly competitive industry where competitors compete based on product offerings, product innovation, product features, and marketing programs. I believe this acquisition can significantly strengthen the company’s position in the market as it will anchor a separate fishing platform under its Outdoor Product Segment, which can help it penetrate the market of fishing equipment where current demand is rising and further expected to grow at a rapid pace.

The company does not sell any products related to the fishing equipment & apparel market. Hence I think this acquisition ultimately increases the company’s product offerings, which I believe can significantly increase its addressable market in coming years and further increase its profit margins by selling more diversified fishing equipment products in the market. Also, some of the popular products produced by Simms, such as waders which already have high demand in the market, can act as a supporting catalyst to increase the company’s sales volume by further increasing its profit margins.

What is the Main Risk Faced by VSTO?

Intense Competition

Vista Outdoor competes against other manufacturers with well-known brand names and commanding market positions in a highly competitive industry. The company competes against other manufacturers with well-known brand names and commanding market positions in a highly competitive industry. The company faces several significant competitors in each market due to the variety of its product offerings, including Nikon and Vortex in the optics sector; Hydro Flask, Contigo, Osprey, Yeti, and Nalgene in the hydration systems sector. The company faces Blackstone, Pit Boss, Traeger, and Lodge in the outdoor cooking sector; Schwinn, Bontrager, and Shoei in the bike and snow helmet & accessories sectors and Nikon, Garmin, and Trackman Price, product innovation, quality, performance, styling, reliability, and product features are just a few of the variables that influence competition in the markets where the company competes. Competition can reduce product prices, which can adversely affect a company’s operations, financial condition, or results of operations.

Valuation

The company’s acquisition of Simms Fishing Products can accelerate the company’s growth by penetrating into the fishing product market, which is rapidly growing. Also, Simms produces certain products such as waders, demand for which is very high and can act as a supporting catalyst to increase its sales volume.

After considering all the above factors, I am estimating EPS of $7.35 for FY2023 which gives the forward P/E ratio of 3.56x. After comparing the forward P/E ratio of 3.56x with the sector median of 11.77x, I think the company is undervalued. The company faces intense competition in the market. In the current rising inflationary scenario, the competitors might fight based on price, which can contract the company’s profit margins in the coming years. That is why I believe the company might trade below its sector median.

After considering all these factors, I estimate the company might trade at a P/E ratio of 6.30x, giving the target price of $46.30, which is a 76.8% upside compared to the current share price of $26.19.

Conclusion

Vista Outdoor recently acquired Simms Fishing Products, which I think can accelerate the company’s growth by introducing it to a new market segment with rapidly increasing demand. The company operates in a highly competitive industry. In the current rising inflationary scenario, the competitors might fight based on price, which can contract the company’s profit margins in the coming years. After comparing the forward P/E ratio of 3.56x with the sector median of 11.77x, I think the company is undervalued. After analyzing all the above factors, I assign a buy rating for Vista Outdoor.

Credit: Source link