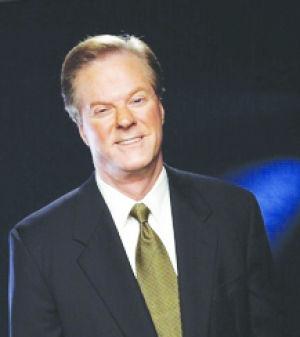

There is no place like Louisiana on this earth, and I think that when my days are over, I’ll find heaven to be no different from Louisiana – maybe a little bit cooler in the summer.” — Governor Mike Foster

Governor Foster passed away last week, leaving a legacy of numerous positive accomplishments during his time in public life. I worked closely with the governor on a number of important issues during the time I served as Insurance Commissioner.

Fly fishing, and insurance problems involving Governor Foster converged one spring day when I was vacationing at our family home in the North Carolina Mountains. Some years back, I went there over Mardi Gras. One morning, I was at Faye’s General Store drinking coffee around 7:30 a.m. when the phone rang. One of the locals picked it up and told me that Governor Mike Foster was calling. Now, remember, it’s 6:30 a.m. in Louisiana, and it’s Mardi Gras. I thought it was wife Gladys playing a joke on me.

But, no, it was the governor on the line. “Jim, Mike Foster. Got a minute?”

“Morning, Governor. You sure know how to run a fellow down, don’t you?”

“I called Gladys, she told me you’d gotten out early. I don’t want to disturb your fishing, but I just want to talk a little insurance with you.”

My coffee drinking companions at Faye’s had a hard time believing that the Louisiana governor would call me up in the North Carolina Mountains at the crack of dawn on a state holiday to discuss insurance business.

While still in the state senate, Governor Foster had created the Louisiana Worker’s Compensation Corporation to help small businesses that were having trouble finding insurance coverage for their employees. Even as governor, he was concerned about a healthy insurance climate.

Let me share a story of how effective an aggressive governor can be. Under the old system of setting automobile insurance rates, the governor appointed a six-member insurance rating commission. Insurance companies had to appear before the commission and make their case for any rate increase. As insurance commissioner, I served as chairman of the commission. The system provided a good check and balance.

State Farm Insurance Company asked the commission for a major rate increase in December 1997. Governor Foster called me and asked that I convey to the members that he wasn’t for any rate increase, particularly as the holidays were approaching. I told the commissioners of the Governor’s concerns, but State Farm did a major lobbying job of wining and dining them. In spite of joint objections from both the Governor and me, the commission unanimously approved the State Farm rate increase.

The next morning around 6:30 a.m. my phone rang. “Jim, Mike Foster. Sorry to bother you so early, but I have one question. Did you tell my appointed commissioners of my concern that no rate increase should be given to State Farm?” I told him, yes, I had conveyed his message to each of the six commissioners. “Thanks, that’s all I needed.”

Three hours later, Governor Foster called a press conference and fired all six commissioners. An insurance company needs to have a fair rate in order to stay in business. But gouging the property owner without justification is not fair to the insured, and bad for economic growth in the state.

The Legislature, the governor and the insurance department could learn a good lesson from the Foster years. Be fair, but don’t let rate increases take place at a company’s whim. Policyholders were better served under Mike Foster.

Jim Brown is a former Commissioner of Insurance, Secretary of State and state senator from Ferriday. His past columns can be read at www.jimbrownusa.com.

Credit: Source link