Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

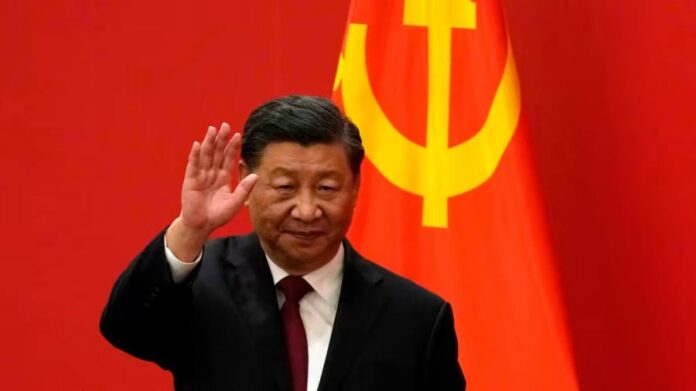

Investors worldwide issued a sceptical verdict on Xi Jinping’s third term in office, selling shares in Chinese companies after the country’s leader wrapped up a Communist party congress that signalled a shift in focus from the economy to security.

The sell-off began yesterday morning in Asia, where Hong Kong’s Hang Seng Tech index fell 9.7 per cent, a one-day move that matched its largest ever drop. It continued into the US trading day, where several of the most well-known Chinese tech groups listed on Wall Street fell sharply.

Nasdaq’s Golden Dragon index, which tracks US-listed shares in Chinese companies, fell 14.4 per cent as Alibaba, JD.com and Pinduoduo faced heavy selling. The record one-day drop for the index left it down by about 50 per cent this year.

Analysts said that the sell-off was compounded by Beijing’s release of economic data, delayed while the party conference was under way, that showed China’s economy grew by 3.9 per cent year-on-year in the third quarter, below the government’s annual goal of 5.5 per cent.

But they also noted that Xi’s overhaul of the party leadership during the week-long 20th party congress, which ended at the weekend, had given power to loyalists more concerned with China’s geopolitical rivalry with the US than with economic reform.

Five more stories in the news

1. Rishi Sunak to become UK prime minister Rishi Sunak is set to enter Downing Street today as Britain’s youngest prime minister in modern times and its first non-white leader, with a vow to get to grips with the “profound economic challenge” facing the country. (He’s also the first with an MBA and a past life at Goldman Sachs.)

2. US charges Chinese officers with interference in Huawei probe The Department of Justice alleged two Chinese citizens paid a US law enforcement officer $61,000 in bitcoin to obtain information on the prosecution against a big Chinese telecoms company reported to be Huawei. The DoJ disclosed two additional cases each of which “lays bare the Chinese government’s flagrant violation of international laws”, FBI director Christopher Wray said.

3. West sees Russia’s ‘dirty bomb’ claims as pretext for escalation A flurry of phone calls from Russia’s defence minister Sergei Shoigu warning of a “dirty bomb” attack has sent alarm bells ringing in western capitals nervous about Moscow’s threats to use nuclear weapons against Ukraine. The threat was condemned by the US, UK and France as an attempt to lay the ground for a “false flag” attack blamed on Ukraine.

4. Yen swings as traders speculate about third intervention After starting the morning in Japan at around ¥149.71 per US dollar, the yen exploded to reach ¥145.56 at 8.44am in the space of a few minutes yesterday. But by the afternoon the yen was back at the level before the morning surge began, prompting speculation that the Bank of Japan had once again entered the currency market to buy the yen.

5. Hedge fund manager predicts Japan-style bear market Global stock markets could be heading for a Japan-style bear market lasting decades, said Boaz Weinstein, who runs New York-based Saba Capital which was one of the world’s top-performing hedge funds in the market turmoil of 2020. “I’m very pessimistic. There isn’t a rainbow at the end of all this,” he told the Financial Times.

The day ahead

Singapore CPI inflation rate data The city-state’s headline and core inflation are expected to increase when the September consumer price index is published today. Use our global inflation tracker to see how your country compares.

Future Investment Initiative The event dubbed “Davos in the Desert” will begin in Riyadh today. Although relations between the US and Saudi Arabia may have plunged to a new low, American banks and investors are still flocking to the conference.

Australia Budget announcement Treasurer Jim Chalmers will present what has been billed as a “family-friendly” Budget on Tuesday. But wage growth will not keep up with inflation in the first federal Budget of the Albanese government, the treasurer has said. (ABC)

World Movement for Democracy’s Global Assembly The organisation’s 11th annual summit will kick off in Taipei today with hundreds of democracy activists, experts and policymakers expected to attend.

What else we’re reading

The Taiwanese chipmaker caught up in the tech cold war TSMC finds itself at the centre of both a tug of war between Washington and Taipei and the fiercest front in the new cold war between China and the US. Meanwhile, Taiwan’s determination to keep as much of the industry as it can on the island is clashing with US strategic goals and its fears of China.

Xi Jinping’s China and the rise of the ‘global west’ In its efforts to counter China’s global influence, the US is looking to a network of allies, which can loosely be called the “global west”. If it is to keep this group together, the US will have to persuade its partners that the darkest fears about Russia and China are justified, writes Gideon Rachman. Recent scenes from Beijing help to make that case.

Office workers embrace hybrid working as post-pandemic norm Trips to workplaces in the world’s seven largest economies are still well below their levels before the coronavirus took hold in early 2020, according to a Financial Times analysis of phone-tracking movements published by Google.

The fight over prized JPMorgan wealth clients Infighting at JPMorgan Chase over how to manage the fortune of retired baseball star Alex Rodriguez has escalated into a two-year battle within the bank, involving prominent personalities such as pop star Jennifer Lopez and author Malcolm Gladwell, as well as chief executive Jamie Dimon.

“I thought he was supposed to be a statesman, Jamie Dimon. This is like a game an 11-year-old would play,” Gladwell told the FT.

‘Big Brother’ managers should turn the lens on themselves The number of employers using data surveillance software to monitor employees has doubled since the start of the pandemic, writes Rana Foroohar. The rise of workplace surveillance represents what Microsoft chief executive Satya Nadella has called a new “productivity paranoia” on the part of employers.

Travel

In the wilds of northern Iceland, Ineos billionaire Jim Ratcliffe is on a mission to save the Atlantic salmon. He is buying up rivers in a bid to protect the species — while also enjoying some of the world’s best fly-fishing.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

Recommended newsletters for you

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Long Story Short — The biggest stories and best reads in one smart email. Sign up here

Credit: Source link